U.S. Customs and Border Protection has deployed enhanced Automated Commercial Environment (ACE) capabilities related to Entry Summary, Accounts and Revenue (ESAR) that will provide new Electronic Data Interchange (EDI) capabilities specific to the Automated Broker Interface (ABI) processing of post summary corrections for entry summaries filed in ACE.

· Trade participants will be able to submit a post summary correction (PSC) for an existing ACE entry type 01 and 03 entry summary. Type 11 informal entries are NOT eligible for post summary corrections.

· The PSC will replace the existing entry summary as a new version of the entry summary on file with CBP and will be processed through existing validations including Census warnings. The version increases to the next whole number, (e.g., 2.0 in ACE reports).

· PSCs can be made at the header or the line level of the ACE entry summary or both.

· The (PSC) transaction is a trade submitted ABI “AE” transaction

· The PSC will replace the existing Post Entry Amendment (PEA) hardcopy process for all ACE entry summaries.

· All entry summaries including PSCs may be subject to team review. CBP will not review each PSC.

· CBP will consider the PSC to be the importer’s assertion that the entry summary data is correct. CBP will accept the data as the most up to date information available and will change the associated collection information to reflect any resulting monetary changes.

· If a PSC is filed by someone other than the original filer, the original filer will not get a courtesy notice of liquidation via ABI

· Filers under NILS will NOT be impacted. They will still receive the courtesy notice of liquidation if they have been designated by the importer even if they are NOT the PSC filer. The same is true for filers when the importer has filed a CBP Form 4811 naming them as the recipient of the bills, refunds, and liquidation notices.

· An authorized ACE entry summary filer may submit a post summary correction for an ACE entry summary originally submitted by another ACE entry summary filer if authorized by the same importer of record. (This feature will be coming soon to SmartBorder)

· The act of filing a PSC will constitute “customs business” as defined in 19 C.F.R.111.1

· The "PSC filer" is a new field within ACE which identifies the filer that submits the PSC.

· If the PSC is filed by someone other than the entry summary filer, ownership of the entry summary moves to the PSC filer. Only the PSC filer will be able to view the specific entry summary that was corrected. The filer of the original entry summary will receive an Entry Summary Status Notification (UC) message when a PSC has been filed, but will not have visibility to the new filing. The entry filer will also be able to run an ABI query and view limited information on the entry summary that was corrected.

To file a post summary correction for an existing ACE type 01 and 03 entry summary, the original entry summary or previously filed PSC must meet the following criteria:

· The entry summary cannot be liquidated.

· The entry summary must be fully-paid or revenue free. This means for entry summaries included on a periodic monthly statement, it may be up to 45 days following the entry date before CBP receives payment for the statement.

· The entry summary must be in “accepted” status and in “CBP control.”PSCs must be filed within 270 calendar days of the date of entry. The PSC cannot be filed within 20 calendar days of the scheduled liquidation date.

· ACE will reject the transmission and the filer must file a protest if the entry summary is less than 21 days from the liquidation date.

· The entry summary cannot be under CBP review. The filer will receive a message indicating “PSC not allowed-under CBP Review” if a PSC is submitted when the entry summary is in CBP review status.

· Reconciliation fields such as flagging or unflagging an entry summary are not permitted using PSC.

· A text explanation and at least one reason code are required for each PSC submission.

· There are NO limitations to the number of PSCs that can be submitted for any one entry summary as long as the PSC is within the permitted time frame and all other requirements are met.

· An AD/CVD entry type 03 cannot be changed to another entry type using a PSC.

· Entry summaries cannot be flagged or un-flagged for reconciliation using a PSC.

Data elements that cannot be changed via a PSC include the following:

· Importer of record

· Consolidated summary indicator

· District/port of entry

· Cargo release certification request indicator (including Department of Transportation (DOT) grouping, Food and Drug Administration (FDA) grouping

and Participating Government Agency (PGA) grouping.)

· Live entry indicator

· NAFTA indicator

· Reconciliation issue code

· Preliminary statement print date

· Periodic statement month

· Statement client branch identifier

· Location of goods

· Any release detail (release entry filer code, release entry number)

This next section will walk you through completing your Post Summary Corrections in SmartBorder. Please review the below information and screen shots to better understand this process.

There are two places where you can enter in the Post Summary Correction information, but the Entry Summary must be transmitted from the Transaction screen.

The first place is on the line item for changes that apply to the line level. Open up your Line Item screen and scroll towards the bottom. You will see a button that says PSC Line Info.

When you click on that button, another screen will appear – Post Summary Correction (PSC) Line Info.

You will see 5 possible PSC Reason Code fields. You can list up to 5 different reasons if necessary. If you click on the ellipsis button, another screen will appear with a list of your reasons to choose from.

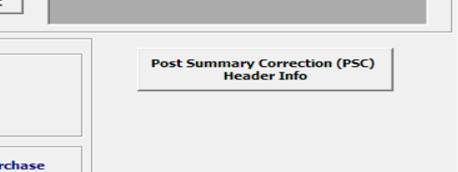

The second place you can add in your Post Summary Correction is on the header. To do this make sure you have the Release/Entry Editor screen and scroll towards the bottom. You will see the Post Summary Correction (PSC) Header Info button.

When processing a PSC (Post Summary Correction) for another Filer Code you MUST follow these steps:

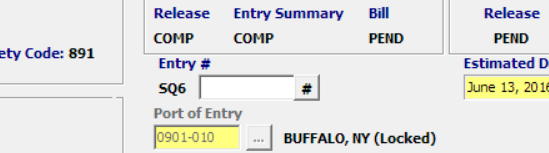

Create a new ENTRY in SmartBorder. Leave the Entry # field BLANK

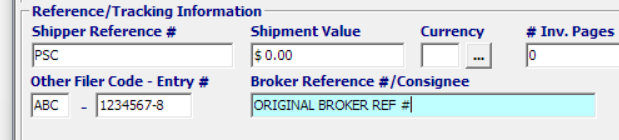

Insert the Original Filer Code and Entry # in the OTHER section

The Broker Reference # MUST be the same as the ORIGINAL Entry. Your PSC will NEVER get accepted if the Broker Reference # does not match. NOTE, the CATAIR only allows up to 9 characters in the transmission.

Key your Entry using the data from the Original Entry with the EXCEPTION of making your necessary PSC changes.

Be sure to complete your PSC Line Item and/or your PSC Header Details

Be sure you do NOT have the Certify Release from Entry Summary checkbox checked

Save Entry as complete and close the Entry. Transmit Entry Summary from the Transaction screen ONLY.

TOOLS ---- > TRANSMIT ---- > Entry Summary