|

Field/Button |

Description |

|

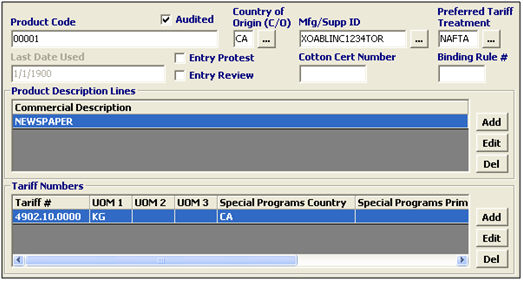

Product Code |

Enter the product code, which is the unique code used to identify the product. You can have the system auto-assign this number if desired. |

|

Audited |

Check this box to indicate that the line has been audited. You can have a default set that will prevent the user from selecting a product that hasn’t been audited. |

|

Country of Origin |

Enter the ISO code for the country of origin, or choose from the pick-list by clicking the ellipsis. Enter the province of origin for products of Canadian origin. |

|

Mfg/Supp. ID |

Enter the Manufacturer ID, or choose from the pick-list by clicking the ellipsis. |

|

Preferred Tariff Treatment |

Choose the code that indicates the clients’ preferred tariff treatment for this product by clicking the ellipsis. |

|

Entry Protest |

Click this box to flag entries containing this product, for use in ADHOC reporting. |

|

Entry Review |

Click this box to flag entries containing this product for an entry review. |

|

Cotton Cert Number |

Enter the cotton certificate of eligibility number. |

|

Binding Rule # |

Enter a binding rule number if the client has a USC binding ruling on the product. |

|

Add |

Click to add a new commercial description or tariff number. |

|

Edit |

Click to edit the selected commercial description or tariff number. |

|

Del |

Click to delete the selected commercial description or tariff number. |

Add/Edit Tariff Information using the Tariff Information screen.

|

Field/Button |

Description |

|

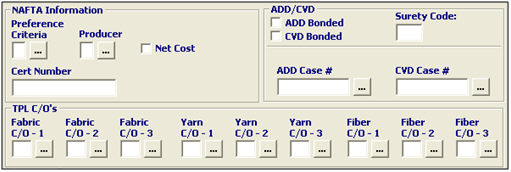

Preference Criteria |

Enter the NAFTA preference criteria, or choose from the pick-list by clicking the ellipsis. |

|

Producer |

Enter the code to indicate that the exporter is also the producer, or choose from the pick-list by clicking the ellipsis. |

|

Net Cost |

Check this box to indicate that the net cost method was used to determine the NAFTA qualification. |

|

Cert Number |

Enter the NAFTA certification number. |

|

ADD/CVD Bonded |

Check the appropriate box to indicate that the ADD/CVD is bonded for this product. |

|

Surety Code |

Enter the surety code of the insurance company underwriting the bond that covers this ADD/CVD. |

|

ADD Case # |

Enter the anti-dumping duty case number for this product, or search for the appropriate case number by clicking the ellipsis. |

|

CVD Case # |

Enter the countervailing duty case number for this product, or search for the appropriate case number by clicking the ellipsis. |

|

Fabric C/O |

Enter the fabric country of origin, or choose from the pick-list by clicking the ellipsis. |

|

Yarn C/O |

Enter the yarn country of origin, or choose from the pick-list by clicking the ellipsis. |

|

Fiber C/O |

Enter the fiber country of origin, or choose from the pick-list by clicking the ellipsis. |

|

Field/Button |

Description |

|

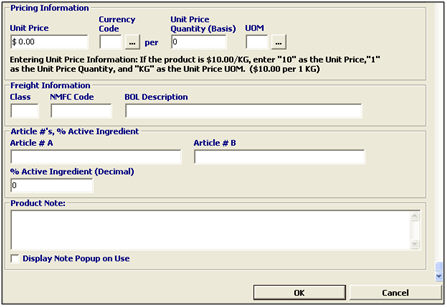

Unit Price |

Enter the unit price (per quantity) at which the goods are sold. |

|

Currency Code |

Enter the currency code, or choose from the pick-list by clicking the ellipsis. |

|

Unit Price Quantity/UOM |

Enter the unit price quantity and unit of measure. If the unit price is $1 per 25kg, then you would enter 1 in the unit price, 25 in the quantity, and enter/choose KG as the unit of measure. |

|

Freight Class |

Enter the freight class for this product, which should be between 50 and 500. |

|

NMFC Code |

Enter the National Motor Freight Classification (NMFC) code for this product. |

|

BOL Description |

Enter the bill of lading description of the product. |

|

Article #s |

Enter the identification number assigned by a supplier or buyer to similar or identical products. Use article B if there are multiple numbers (supplier & buyer each have unique article/product numbers). |

|

% Active Ingredient |

Enter the percentage of the active ingredient in the product. This will transfer to the Misc. tab on the line item for the AII. |

|

Product Note |

Enter any notes related to the product. Check the “Display Note Popup on Use” box if you would like to have a pop-up display when this product is used. |

|

OK/Cancel |

OK will save the product. Cancel will cancel and go back to the product list without saving. |