The Tariff Picker is a useful reference tool. This tool features the latest tariff information, updated nightly from CBP’s database when there are changes to the Harmonized Tariff Schedule of the United States. This tool allows the users to search for an accurate tariff classification, as well as to verify most details for a specific tariff. We recommend that you become familiar with this tool, as it can offer a great deal of assistance in the classification of goods.

Accessing the Tariff Picker

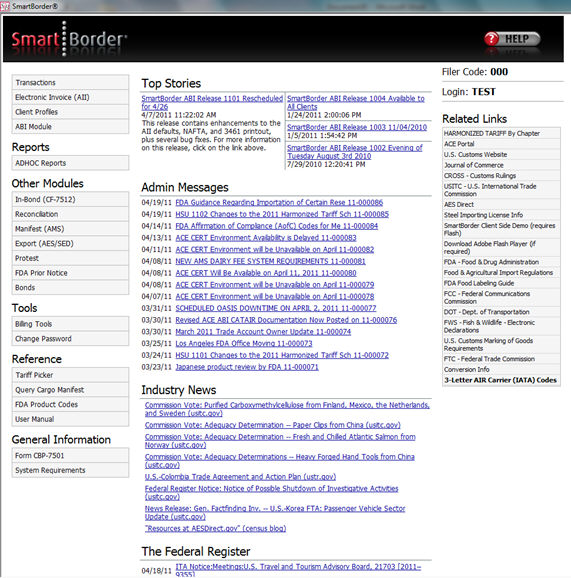

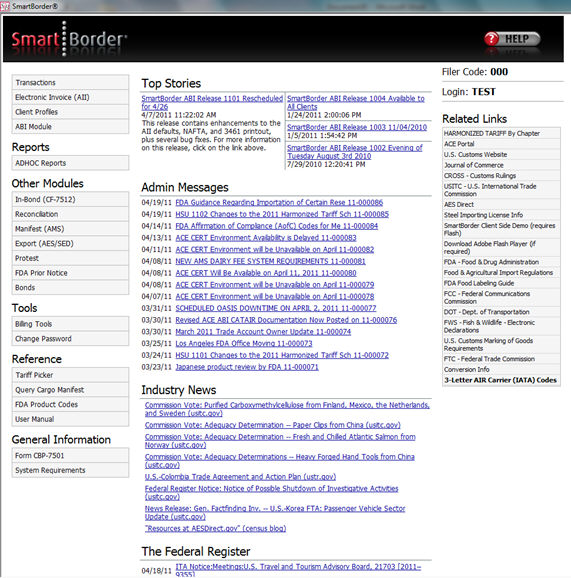

Click the Tariff Picker link, under Reference on the SmartBorder Main Page:

Accessing the Tariff Picker (cont.)

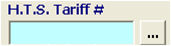

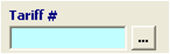

You can also access the tariff picker by clicking the  button, located next to any field in SmartBorder where you would enter a tariff number. (Entry Line Screen, AII Line Screen, etc.)

button, located next to any field in SmartBorder where you would enter a tariff number. (Entry Line Screen, AII Line Screen, etc.)

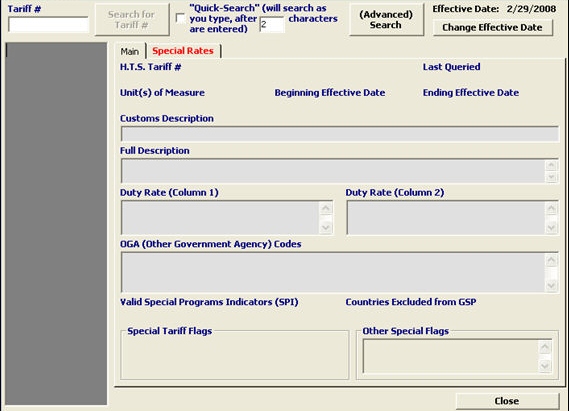

The Tariff Picker Main Screen

Tariff Picker Information/Data Fields

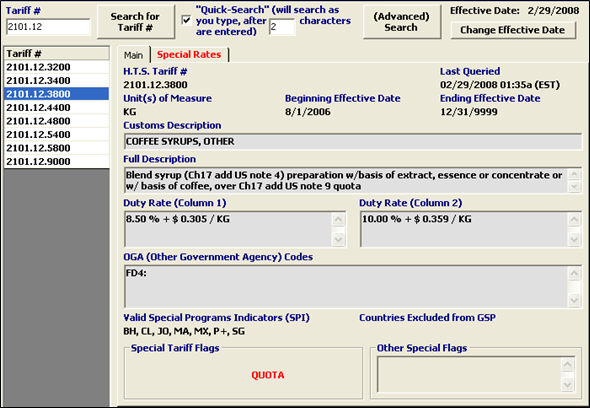

Please consult the screenshots below and the tables on the following page if you are uncertain of the meaning/purpose of a data or information field. This is the information that will display, based on the tariff search criteria. The screenshots below show examples of a tariff classification that has most of these fields in use. The first screenshot shows the Main information fields, and the second shows the Special Rates screen.

|

Field (Main Tab) |

Description |

|

HTS Tariff # |

Displays the 10 digit HTS number that is currently selected or highlighted. The results displayed are for this specific HTS. |

|

Unit(s) of Measure |

The unit of measure that that is required by Customs to be reported when using the selected tariff classification |

|

Last Queried |

The last time SmartBorder queried the selected HTS against the record in Customs system. This is automatic, and done nightly |

|

Beginning Effective Date |

The date that the tariff # became/is becoming effective. |

|

Ending Effective Date |

The date that the tariff # is no longer valid |

|

Customs Description |

The Customs description of the products. This is also sometimes referred to as the “short description” |

|

Full Description |

This is the full description of the HTS classification selected |

|

Duty Rate (Column 1) |

The duty rate applicable in column 1 of the HTS. |

|

Duty Rate (Column 2) |

The duty rate applicable in column 2 of the HTS. |

|

OGA (Other Government Agency) Codes |

This will display the OGA codes, when the selected tariff has been flagged for OGA required (or may be required): These include FDA(Food and Drug), FCC(Federal Communication), DOT(Dept. of Transportation), FWS (Fish and Wildlife), etc. |

|

Valid Special Programs Indicators (SPI) |

A listing of the countries that have an agreement with the United States for preferential treatment |

|

Countries Excluded from GSP |

A listing of the countries that are excluded from the Generalized System of Preferences (GSP) |

|

Special Tariff Flags |

Any special requirements for the selected tariff. These include quota, ADD/CVD, additional HTS required, Textile category #, etc. |

|

Other Special Flags |

Any special flags for the selected tariff will display here. These include F250 (Formal entry required if value over $250) and FALW (Formal entry always required) |

|

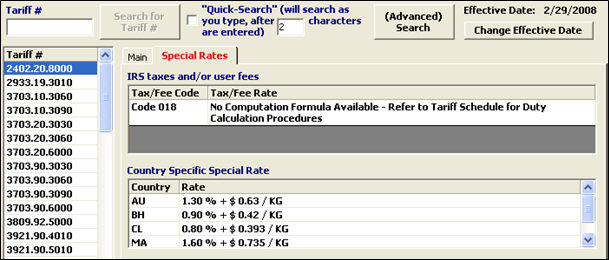

Field (Special Rates Tab) |

Description |

|

IRS Taxes and/or User Fees |

IRS taxes or other user fees, to be applied to this tariff, will be listed here |

|

Country Specific Special Rate |

If a special rate applies to a particular country it will be listed here. |

***For more information on basic or advanced searches please see : Basic Search and Advanced Search